Employment Agreements

We have previously entered into employment agreements with each of our named executive officers. The term of each of these employment agreements is for an undetermined period.

Each named executive officer that is party to an employment agreement is entitled to receive the base salary set forth in such named executive officer’s employment agreement, subject to the raises that we have provided to those named executive officers throughout the terms of their employment. In addition to base salary, the named executive officers may receive bonus compensation as we, in our sole discretion, elect to pay them in accordance with the bonus plan policy. The named executive officers are also entitled to reimbursement for reasonable out-of-pocket expenses that they incur on our behalf in the performance of their duties as named executive officers.

The employment agreements provide that, during a named executive officer’s employment and for so long afterwards as any pertinent information remains confidential, such named executive officer will not use or disclose any confidential information that we use, develop or obtain. The agreements provide that all work product relating to our business belongs to us or our subsidiaries, and the named executive officer will promptly disclose such work product to us and provide reasonable assistance in connection with the defense of such work product.

The agreements also provide that, during a named executive officer’s employment, and for a period of one year after the end of the named executive officer’s employment in the event of termination without “just cause,” and two years in the event of resignation or termination for “just cause” (the “non-competition period”), the named executive officer will not (1) compete directly or indirectly with us, (2) induce our or our subsidiaries’ employees to terminate their employment with us or to engage in any competitive business or (3) solicit or do business with any of our present, past or prospective customers or the customers of our subsidiaries.

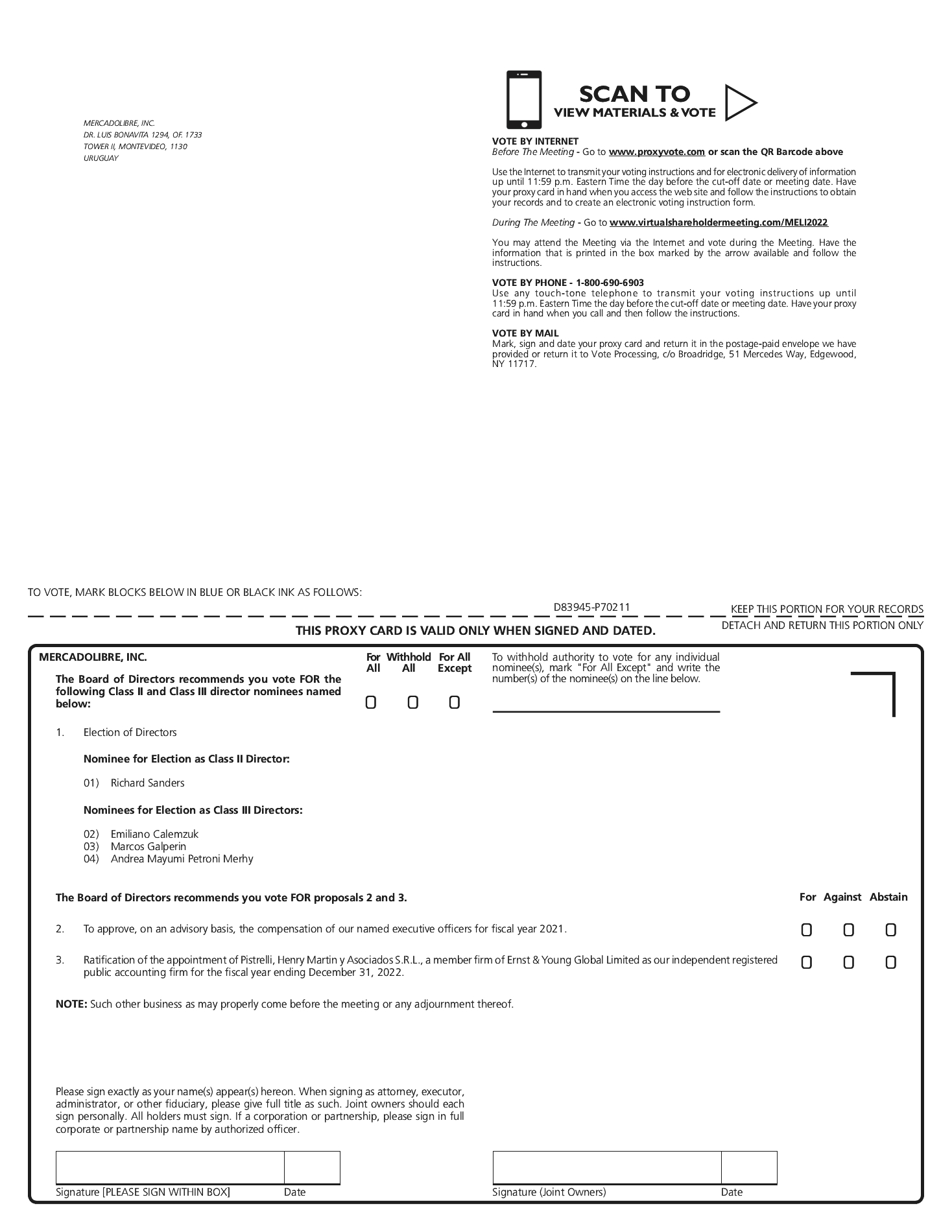

Potential Payments Upon Termination or Change in Control

We may terminate a named executive officer’s employment in the event that we determine, in our sole discretion, that there is “just cause” (as defined below)(determined pursuant to, and in accordance with, local law). If we terminate a named executive officer’s employment for “just cause,” such named executive officer will not be entitled to receive any severance benefits, except for severance obligations mandated under the laws of the country where the named executive officer resides. If we terminate the named executive officer’s employment without “just cause,” such named executive officer shall be entitled to a lump sum severance payment in an amount equal to the greater of (x) one year’s gross base salary or (y) the severance obligations mandated under the laws of the country where the named executive officer resides.

“Just cause” means and includes (1) the commission by the executive officer of any gross misconduct or any offense serious enough for the relationship to become impossible to continue, including without limitation, the executive officer’s willful and continuing disregard of the lawful written instructions of our board or such executive officer’s superiors, (2) any action or any omission by the executive officer, resulting in such executive officer’s breach of his duty of loyalty or any act of self-dealing, (3) any material breach by the executive officer of his duties and obligations under the employment agreement as decided by our board and (4) the executive officer’s conviction, in our board of director’s sole discretion, of any serious crime or offense for violating any law (including, without limitation, theft, fraud, paying directly or indirectly bribes or kick- backs to government officials, the crimes set forth in the U.S. Foreign Corrupt Practices Act of 1977 or the foreign equivalent thereof and the executive officer’s embezzlement of funds of our Company or any of our affiliates).

In September of 2001, we implemented the 2001 Management Incentive Bonus Plan (the “Incentive Plan”). As established in the Incentive Plan, our chief executive officer established which officers would be eligible for the Incentive Plan. Pursuant to the Incentive Plan, in the event we are sold, the eligible officers, as a group, are entitled to receive a “sale bonus” and a “stay bonus.” If the purchase price is equal to or greater than $20,000,000 then the eligible officers as a group are entitled to receive (1) a sale bonus equal to 5.5% of the purchase price and (2) a stay bonus equal to 7.1% of the purchase price, subject in both cases to a maximum combined cap of $78,335,000. If the purchase price is less than $20,000,000, then the eligible officers, as a group, are entitled to receive the “stay bonus” only. The bonuses are divided between the eligible officers, including our named executive officers and others, according to the participation percentages established by our chief executive officer, in accordance with the Incentive Plan. All payments under the Incentive Plan would be made in a lump sum payment.

For additional information regarding potential payments under our LTRPs in the event of a termination of employment, see “—Elements of Compensation—Long-Term Retention Plan—20212023 Long-Term Retention Plan” and “—Prior Long-Term Retention Plans”.